Questions About 1031 Exchanges?

Request your free 1031 Exchange Roadmap from Plenti Financial. Please feel free to reach out with any questions or to start your 1031 exchange or real estate financing process.

Please complete the form for your 1031 Exchange Roadmap.

What is a 1031 Exchange?

A 1031 Exchange is an IRS process that allows you to save 30-40% in federal and state income taxes on the profits from the sale of your investment property.

Contact info

How Does A 1031 Work?

STEP 1: Buy an Investment Property

Purchase a property for $100k.

STEP 2: Decide to Sell and Hire a 1031 Exchange Accommodator

(That’s us!)

STEP 3: Sell Your Property for a Profit

Property sells for $300k, a $200k profit.

STEP 4: Identify a New Investment Property/Properties within 45 Days

Two $150k purchases.

STEP 5: Finalize the New Investment Property and Close within 180 Days

Total investment $200k. 100% of profit reinvested.

STEP 6: Celebrate because You Sold Your Investment Property Tax-Free!

Saved up to 40% in taxes or 80k.

How Does A 1031 Work?

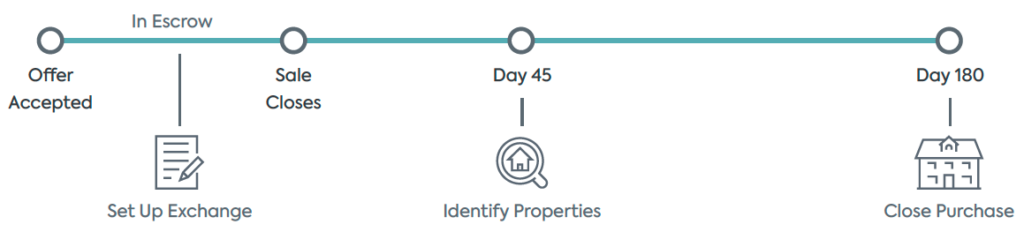

Your 1031 exchange must be set up BEFORE your sale closes. Then, from the closing date of your sale (Day 0), you’ll have 45 days to finalize and identify the properties you’re planning to purchase, and 180 days in total to complete the purchase(s) of your new property.

Ready to get started?

We know that 1031 exchanges, real estate financing, and everything in between can be confusing, and a 10 minute phone call can help clear things up. So give us a call or schedule a consultation today, and we’ll be happy to talk through your specific needs.