Introduction

The ‘1031 Exchange’ is a tax-break from the IRS that allows real estate investors to sell their investment property without paying capital gains taxes. Typically, when a piece of investment real estate is sold, taxes take about 30-40% of the profit. If the property qualifies for the 1031 exchange tax-break however, these taxes DON’T have to be paid!

Rules & Requirements – Overview

To fully avoid the 30-40% in taxes, the 1031 exchange tax-break requires that an investor reinvest all of the cash equity from their sale into new investment property of equal or greater value (relative to the sales price).

For example, if an investment property is sold for $800,000 with $350,000 of equity in it, an investor would need to reinvest the $350,000 in equity into new investment property worth at least $800,000 to fully satisfy the 1031 exchange requirements and avoid paying any capital gains taxes on the property they sold.

If an investor would like to take some cash at closing (and pay taxes on it), or buy property of lower value than what he/she sold, he/she can do a ‘partial’ 1031 exchange to shelter a portion of their profits from capital gains taxes.

Timeline – Overview

The 1031 exchange tax-break also has a very particular timeline that must be followed:

A 1031 exchange must be set up BEFORE an investor closes on the property they’re selling. The investor then has 45 days from the closing date of his/her sale to identify the properties he/she is planning on reinvesting in and, in total, 180 days from the closing date of his/her sale to actually close on any of the replacement properties that he/she identified.

Protecting and Building Wealth with 1031

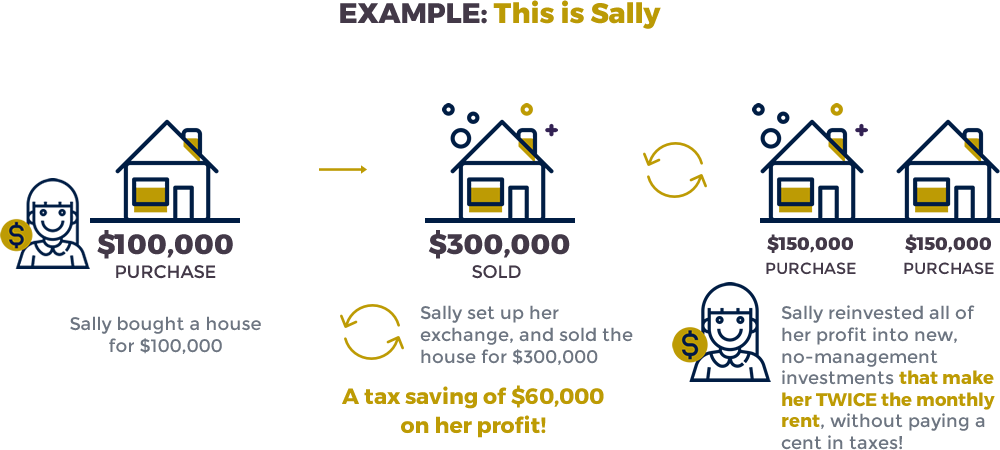

1031 exchanges are a great wealth-preservation and wealth-building tool for real estate investors. Not only can 1031 exchanges be used to shelter real estate profits from taxes; they can also be used to reposition the equity from properties with a lot of equity built up in them into new investments that can generate a higher rate of return on that equity. This has the potential to provide real estate investors with more monthly cash flow than they were generating before. Take a look at the example below:

This is just one of the many ways that 1031 can be used to help preserve and grow wealth!

As with any investment property, the new properties purchased in a 1031 exchange also have the potential to build up large amounts of equity and appreciate in value over time, at which point they can be 1031 exchanged again! There is no limit to the amount of 1031 exchanges that an investor can do in his/her lifetime, so this process can repeat over and over, allowing an investor’s real estate wealth to grow tax-free indefinitely!

Reverse – and Improvement – 1031 Exchanges

1031 exchanges can also be done in reverse with a Reverse-1031 exchange, and exchange funds can even be used to make improvements to replacement property using an Improvement-1031 exchange.

Please Note: Rules and regulations are DIFFERENT from those provided on this page for Reverse- and Improvement-1031 exchanges, so please give us a call at 866-944-1031 if you would like to discuss either a Reverse- or Improvement-1031 exchange.

Disclaimer

The descriptions above are solely meant to give an overview of the general guidelines of the 1031 exchange tax-break and are NOT meant to be a comprehensive overview of all 1031 exchange rules and regulations. We encourage every investor to schedule a free consultation to review the 1031 exchange rules and regulations with regards to their specific property prior to beginning a 1031 exchange transaction to make sure that they have a clear understanding of how to follow 1031 rules and regulations for their specific situation.